6 steps to releasing ‘trapped’ cash from your business

Your cash balance is reflecting back to you how well you are doing in running your business. Sometimes is a matter of timing, but sometimes is a matter of knowing where to LOOK and what to DO to make more money.

Now look at your cash balance. What is it telling you? And how is it making you feel? Disappointed? Or eager for what’s coming next? Are you worried and fearful or are you anticipating more cash coming to your business?

If you feel that you ought to be seeing more cash than you currently are seeing then read on……

We are going to show you how to discover the ‘trapped cash’ in your business and what to do to release it.

Of course, your first logical step when trying to make money is to look at your Profitability. This is what you already know how to improve and this is what others are asking you when trying to evaluate the success of your business.

But Profitability is not the only area that holds the answers. Working Capital is the secret place that ‘locks’ your cash. By understanding your Working Capital and working towards improving it you can discover ‘trapped cash’ in your business and work on releasing it.

Often overlooked your business terms and requirements hold most of the answers to your cash flow questions. And Working Capital represents your current business terms and requirements. You just need to be really serious about cash flow to start looking for the answers there.

With that said……let me jump right in and show you how to make more money by uncovering and fixing your Working Capital issues.

Working Capital is the amount of cash that your business needs to trade, and it is generally consumed by two major current assets: your debtors and your inventory. Your trade creditors will fund some of this, so when you are calculating how much money you need to invest in working capital to fulfil your sales always deduct the trade creditors amount from your debtors and inventory amount.

The problem is many companies lack the key metrics to evaluate their Working Capital. And even if they understand their Working Capital , they lack the tools to make the improvements..

Working Capital problem, somehow does not seem to be a business PRIORITY.. The reason? Working Capital issues are not as obvious as profitability issues, hence they are not linked to business and individual performance.

Working Capital issues are not fully understood by business leaders, so they are not made visible to the rest of the team. Working Capital is seen as finance matter that should be dealt with by the Accountant. “We are not in finance!” we hear people say.

The myth is that CEOs think that Working Capital management should be delegated to the Finance team.. “Working Capital is not something that I should be looking at. I’d got to run a business here!” – we hear leaders say.

For most businesses, P&L is the focus, this is how you measure business and operational performance. But cash flow is a result of profit, as well as Working Capital, hence Working Capital management should also be your number ONE priority.

In the next few paragraphs we are going to show you how to make more money by improving your business terms, represented by your Working Capital.

Step 1: Discover

To identify the sources of your cash flow problem you need to first examine your Working Capital and cash flow management to discover ‘trapped cash’.

- Your revenue cycle (sales order to cash)

- Accounts receivable and your collection cycle

- Stock/WIP (Work-In-Progress) management

- Supplier management (purchase order to pay)

During this process you will identify gaps in processes, systems and management-decision making. These gaps are ‘trapping’ your cash and affect how much cash you are left with when managing your business. The more gaps you discover, the more opportunities for improvement you have.

Step 2: Analyse

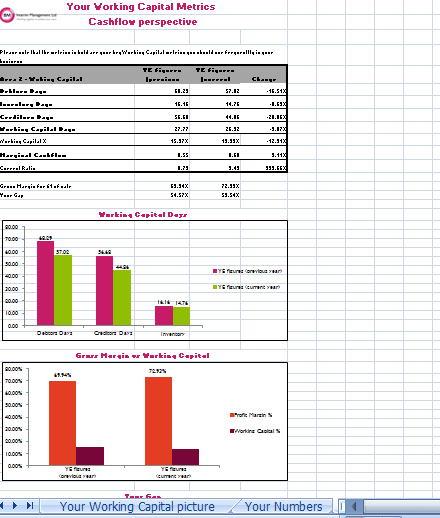

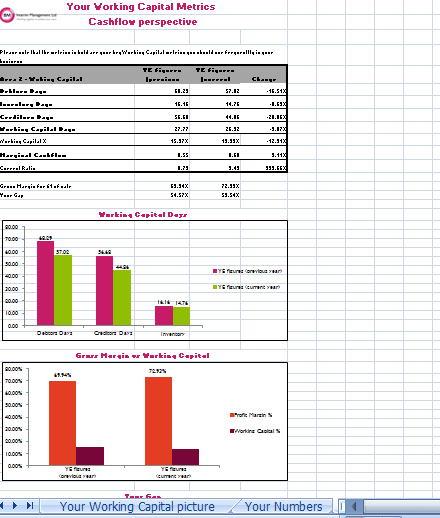

You then need to quantify the effectiveness of your Working Capital. You can do this by using the key metrics for your Working Capital – Debtors Days, Creditors Days, your WIP or Stock days as wells as your working capital days.

Effective working capital is one with less debtors days and stock/WIP days and more creditors’ days (supplier relationships permitting).

For quick results and easy calculation you can use our Working Capital tool . You will need your financials for the last 2 years only. No need for calculation, just input of the key numbers from your financial statements. You will see the instructions on the front page and interpretations of your results on the last page. Go ahead, try it today.

Note: Working Capital items are measured in days, to represent your current business terms and requirements.

> Show me my Working Capital tool! <

Step 3: Challenge your assumptions and beliefs

Try to uncover what is hindering the generation of cash flow in your businesses. This could either be:

- your assumptions and beliefs for what and when you need cash,

- poor management behaviors, or

- your processes and systems.

Although not easy to carry out, this exercise will yield huge pay-offs for you and your business. It will uncover what lies at the heart of the cash flow problem.

We recently did this exercise with one of our clients in the attempt to uncover the rest. The most difficult part was when we challenged the deeply rooted assumptions and beliefs they held about particular areas of the business, mainly related to sales and customers. . We could tell that it was not easy for the client to face their fears, but when they saw the pay-offs from what we were suggesting, they felt massive relief.

Step 4: Agree and implement improvements

This is our favourite step of the whole process, because for you to see more money into your bank account you need to improve continuously. This is when you will start to see the real effect from this process.

All steps up to now are about discovering and analysing. But for you to see the real benefits of this process manifested into your bank account you need to:

- adjusts and improve your processes – financial as well as operational.

- modify your beliefs and assumptions, regardless of how deeply rooted they are within you and your business.

- operationalise best practices for financial, supplier and inventory management.

If you need tools to sustain the improvements, download our Cash Acceleration tool. This will help you identify the key Working Capital drivers, that increase the speed of cash flowing into and within your business. It is also a great tool for discovering new improvement opportunities.

Tip: You might find new ways to make more money with our Cash Acceleration tool. If this is the case, make sure to segment the opportunities into quick wins and long-term improvements. Your quick wins can bring you back in balance quicker. You’d be amazed to see that with focused effort on just a few areas you can achieve significant Working Capital improvements to accelerate results.

Step 6: Align all people involved

It is so important to involve your management team and all individuals contributing to Working Capital management in your improvement efforts. They should be involved in both the discovery processes and in the idea generation for improvement..

Your team should feel empowered. They need to understand the payment terms and also see the profit/cash trade-offs when making decisions. After all cash touches every segment of your businesses, so make the improvements a cross-functional initiative.

You can use the above approach whatever your business model is. We have seen it work time and time again.

Like I said, there is more to cash flow than your P&L. The sooner you understand how your business terms and requirement, represented through your Working Capital, is affecting your cash flow, the sooner you will witness the end of your cash flow worries.

What’s next?

Cash flow is not something you could ignore. It follows you everywhere you go, that’s why it is so important to make it your number ONE priority.

Here is a fraction of what you will enjoy when you follow our process:

-

Improve your cash flow position – that is cash at bank as well as your cash in your bank account. Believe it or not you will be able to discover the “trapped cash” and release it into your bank account.

-

Shorten your cash conversion cycle – that is the time taken for your cash to flow back into your bank account from the minute you spend it on anything. Use our Cash Acceleration tool to stay focused on the improvements.

-

TODAY: map out your revenue cycle (sales order to cash) to see if you can identify opportunities for streamlining the processes or improving decision making. The secret is to approach this with an open mind and challenge what you see as “the norm”.

-

You need funding or factoring facility to solve your Working Capital problem, right? Wrong! The “usual stuff” totally backfires when you really want to increase your cash flow. Here is a new approach, that’s faster, simpler to implement, and better.

-

This is a proven way to improve your cash flow and positions you as the trusted authority in front of your staff, partners, suppliers and your bank manager.

-

Specifically designed for people who are not the “numbers people”. This is really important for you because it puts you in the category money people who know “smart money”.

If you are ready to take your cash flow to the next level then you need to download our Working Capital tool. It has the key metrics for evaluating your Working Capital effectiveness. You will be able to calculate these in a few minutes, as the formulas are already there for you.

> Show me my Working Capital tool! <

RELATED LINKS

Read more about BMIM Cash flow

How we measure the success of your Strategy (WITH FREE TOOL)

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround