Solving Cash flow Concerns….Where do you start?

The interesting fact is that when we talk about cash flow, most people think of Accounts Department and they focus their attention on 2 areas – billing and payment. This is because traditionally, the accounts department has been the one dealing with processing invoices and debt collections.

The truth is that other departments play as important role in cash flow management, if not more important as the Finance Department. For example, if your sales team is not taking any responsibility for non-payment or late payments of their customers, then there is very little your Accounts Department can do in providing optimum solutions that will nurture the long-term relationship with the customer, despite disputes, as well as position you as an important supplier (vendor) to them, so you are always on top of the pile for payment. After all, your sales team holds the key relationships with your customers.

What is the best way to address your cash flow issues?

Have the whole team on board, not just the accounts team, and, have them addressing profit issues, as well as cash flow issues. Clients come to us saying “I’ve got cash flow problem” – we say “No, you don’t. You’ve got profitability problem. Without fixing your profitability, we cannot have rational discussion about cash flow – because if you don’t have profits and we start working on cash flow, we can get those receivables coming in sooner, but your company will still be sinking“.

Here are some clues that can help you start addressing some of your concerns immediately:

STEP 1: Define where you want your business to be with regards to cash and profit.

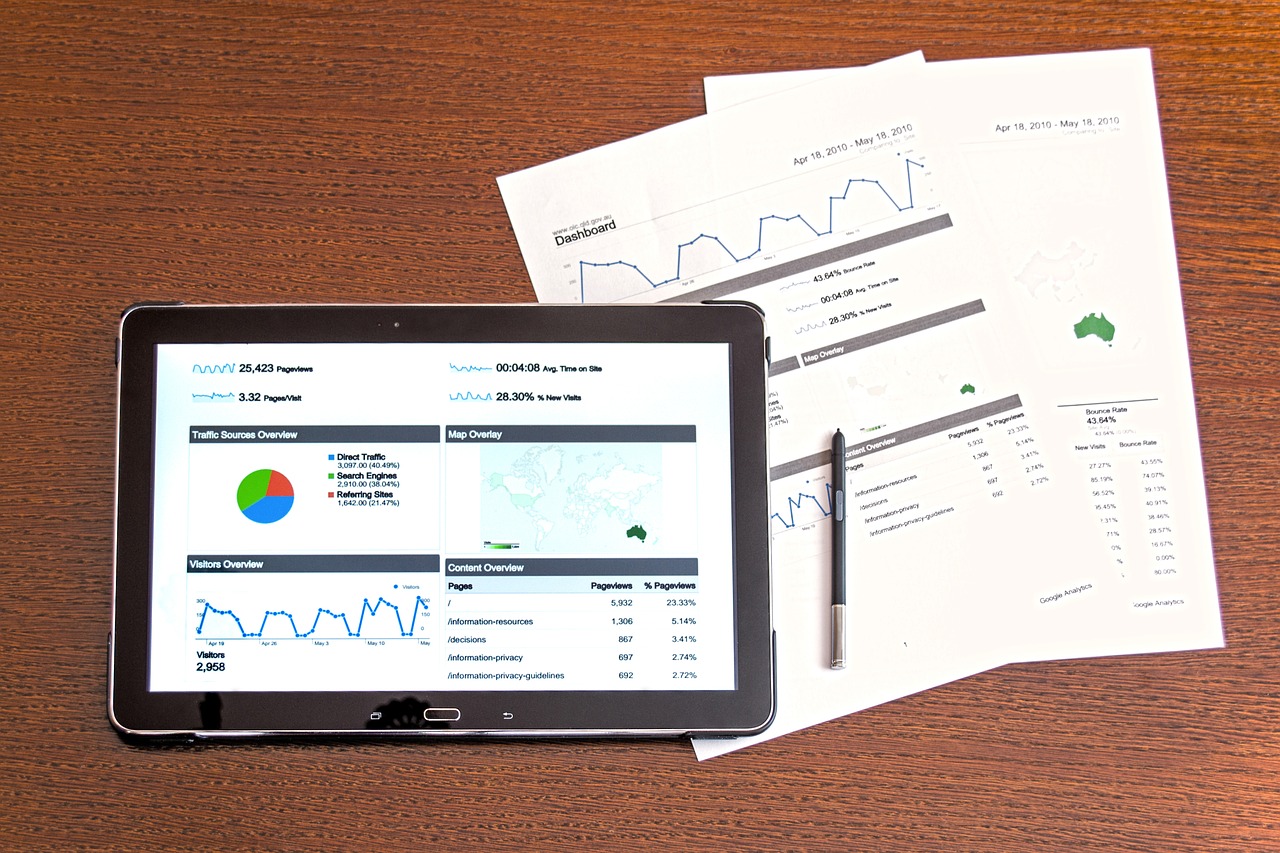

STEP 2: Set up a formal KPI structure against which you can measure your business progress. This should represent the ideal profile for

- Profitability (sales, gross margin, overheads, net profit-before tax)

- Working capital (Accounts Receivable days, inventory/WIP days, Accounts Payable days, working capital)

Then use green, amber, red to colour code the parameters for ‘good’, ‘average’ and ‘bad’ and put the actuals against, so the whole team can see where they are doing ok and where they need to improve.

STEP 3: Roll out the programme across all aspects of your business, so that everyone knows the parameters for success and the progress the company is making:

- Focus your sales team on sales and gross margin results. Since they are responsible for giving out discounts.

- The procurement team (if you have one) should focus on buying products that are enhancing gross margin.

- Have your HR and finance team look after operating expenses.

- Have your sales team and finance monitor Accounts Receivable.

- If you have warehouse team, focus them on monitoring stock levels and if you are service company have your operations team focus on managing work-in-progress (WIP).

- Finance team will look after the Accounts Payable.

Working together, your team can turn around your cash flow very quickly and allow you to sleep at night. Your bank manager will be very happy and will not withdraw your financing facilities, and you will not have to pay huge financing fees to other financing facilities providers.

> Get your Cash flow Performance Tool now! <

RELATED LINKS

Read more about BMIM Cash flow

How we measure the success of your Strategy (WITH FREE TOOL)

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround