How to generate cash to self-finance your business?

“…show the real state of your businesses’ cash position”

Cash is KING! A growing concern of any business owner or a CEO is to optimise use of cash and generation of cash. If your business is growing, can it really keep up with the internal pace of cash flow? A self-cash-generating business is the aspiration of most successful entrepreneurs. So how can you generate the cash you need to self-finance your business?

Whenever we hear there is a cash flow problem we always start with fixing profitability. You can improve cash flow, of course, by negotiating favourable terms with customers and suppliers. However we advise sacrificing your margins only if you are desperate.

To have a financially stable and growing business you need to pay attention at the following:

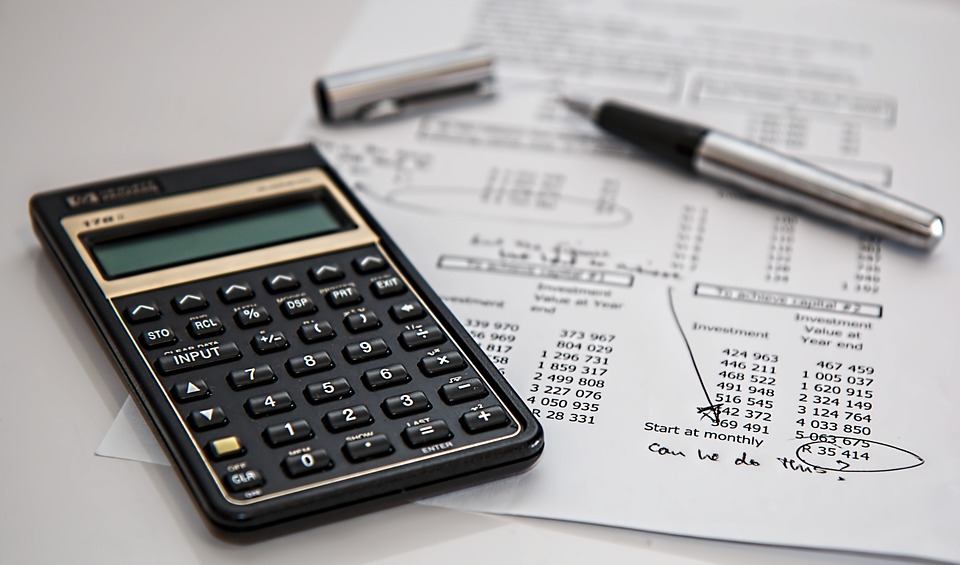

Are your numbers lying to you?

Often businesses manipulate variables to save on tax liability, interest expenses etc. This distorts the true reality of cash flow. What do we mean by this? Say for example, you choose to take less than a fair market wage but excess dividends in your role as the owner. This will show your profits being significantly higher than what they really are and it makes you think that you are more profitable than your truly are.

“…true wealth is created through wise investments of after-tax profits.”

Your primary objective is to show the real state of your businesses’ cash position. Start compensating yourself for the services you render to the company, and decide how profits are distributed (more on this shortly). Remember, true wealth is created through wise investments of after-tax profits. So if you do not pay tax you either have not created enough wealth or you have cheated. Both scenarios are bad. Make sure you set aside cash with the aim of bringing your quarterly tax liability closer to zero, so you do not get surprised by the tax bill.

How are you managing your debts?

Debt is generally not your friend. You should aim to eliminate short-term debt at the end of each quarter, after setting aside money for taxes. If you have a long-term loan, be up to date with the monthly repayments. Lines of credit, such as overdrafts, factoring, etc. are an easy and a quick solution to cash-flow issues. However, you should only draw on it when you are profitable and you need to handle ups and downs on seasonality or to extend credit to your customers. In the case of losing money you should focus on improving your profitability. You may ask, where is the money going to come from? The best strategy is to invest in the customers/activities/product lines that bring the majority of your profit.

> Discover here how DELL increased their cash position from 6BN to 9BN! <

Do you have a Vital Capital?

Vital Capital is an untouched cash reserve post taxes and short-term debts payment. A good target to aim for is approximately 2-months’ of your operating expenses in cash, less costs of goods sold. In our opinion, if your business can meet these criteria it can be considered as fully capitalised. Only then you can start distributing the profits or re-invest them back in the business. If you start distributing profits before debt is cleared you run the risk of making the business undercapitalised. Meeting the Vital Capital target is one of the most rewarding accomplishments your business could achieve. And it takes 18 months only to get there after you have fixed your profitability issues.

“Debt is generally not your friend.”

How do you distribute your profit?

Pay dividends to shareholders and reward employees who helped you get there. You should however, do this only after you have set aside money for taxes, paid all your lines of credit and achieved the Vital Capital target. Paying dividends and bonuses should be a sign that you have created a profitable, cash generating business – the best of both worlds.

“Founders might get stuck working in the business, rather than on the business.”

Did you know that the most successful companies keep 3 to 10 times more cash reserves than their competitors. Very often with growing businesses, Founders might get stuck working in the business, rather than on the business. However, you have to find time everyday to look at your cash – or you can ask your CFO to send you daily report of your cash flows. You may uncover valuable information by taking the time to analyse where exactly cash is tied up in your business. Cash optimisation is a great tool you can use to optimise your cash conversion cycle.

> Download our Cash Optimisation tool now to increase your cash flow instantly! <

Note: The above approach is useful if you are already established in the market and you are on your way to 15% profitability (this is considered to be an indicator that your business still has untapped potential). If you do not have enough business you need to look at your strategy.

RELATED LINKS

Read more about BMIM Cash flow

How we measure the success of your Strategy (WITH FREE TOOL)

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround