Turnover is vanity, Profit is sanity – but Cash flow is reality!

Did you know that 82% of failed businesses have closed down due to poor cash flow management performance? Profits are an opinion only; balance sheet can be manipulated, for the most part – you can amend valuations – but the only fact is the numbers that relate to cash. Hence, your focus, as a CEO, should be on optimising the use of cash and the generation of cash.

A healthy P&L can mask pending cash flow issues and it gets worse as your business continues to grow. You might not know this, but you could be outgrowing your ability to fund your business because you did not pay attention at cash flow. In other words, you could be growing broke.

What does cash flow mean?

When we ask CEOs and their team about Profit, we get the same answer. But we ask about cash flow, the interpretations are very different. When it comes to cash flow, even though, it is used in businesses every day, most business people use it to describe general availability of cash “We need to improve our cash flow” or ” I need more cash flow”.

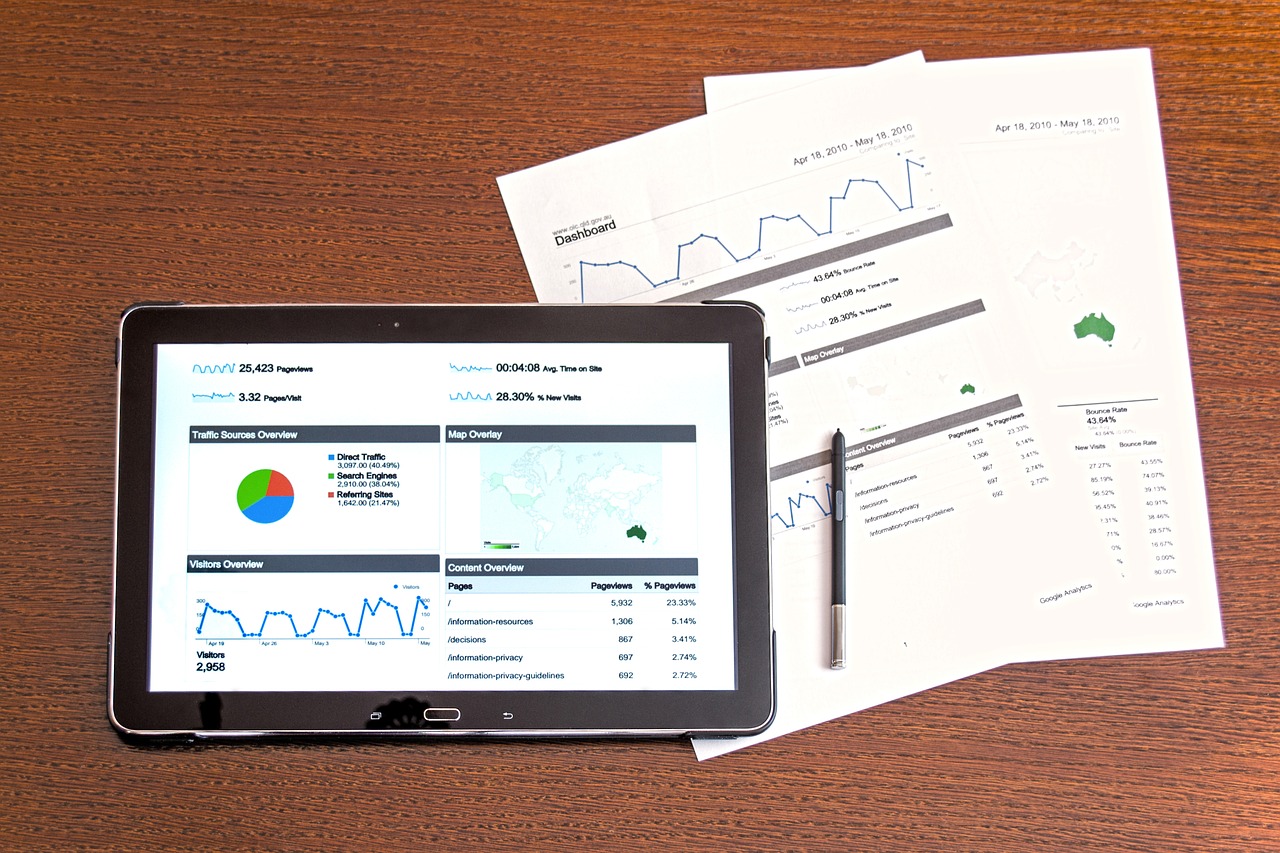

To a Banker, or any Funder, however, cash flow has a specific value. It is a ratio that determines your ability to service your debt. It is a ratio that describes your management competence. They know that you can only pay your debt with future cash, not profits.

The biggest concern is that you and your team are not even aware that you are not doing that great. Just because your sales are growing you think your business is performing really well. But if you are getting short of cash it could be a warning sign for growing broke. You worry about not having enough cash for payroll, to pay your suppliers, to keep your bank manager happy.

When this happens you try to fix your cash flow problem with more sales. This is where you could end up spiralling down. Until you become serious about measuring and growing cash, in addition to Profit, you will often run short.

The truth is that Profit is only a quarter of your cash flow picture.

If you would like to find what makes up the rest download the ebook How to double your cash flow overnight.

Here Bibi Martin gives you the high-level overview of what you need to measure and grow your cash flow so you can stay in control of your business. This is the real key to build a fast cash-making engine! Imagine cash just keeps flowing in: how much easier it would be to run your business? You will have the financial strength you have always desired. You will have the freedom you worked for: total financial independence!

The ebook How to double your cash flow overnight gives you a high-level overview of what you need to measure and grow your cash flow. It is a guide for CEOs who want to generate more cash to fuel business growth.

You can download your copy here or send your questions/comments to info@bmim.co.uk

About the Author

Bibi Martin is the founder of BMIM Cash Flow, with 15+ years of experience working with small and medium sized businesses to aid transformational growth, tripled profitability and doubled the rate of cash flow. She and her team have helped many CEOs turn their cash flow position around in a short period of time.

RELATED LINKS

Read more about BMIM Cash flow

How we measure the success of your Strategy (WITH FREE TOOL)

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround