How to get a bank loan without being rejected

Now that you know this, you want to know how banks view your performance. If you are looking for a bank loan, for example, the banker looks at your turnover, your profitability, your growth projections, your cash flow or just the value of the security you can offer. What if the bank says no to your application? What can you do?

We are going to show you how to get the support from your bank for all your lending propositions. The good news? It is easier that you might think.

The better news? We will show you what information you need to give your bank when applying for a bank loan, an overdraft or a line of credit, even some form of asset-based lending.

The best news? We will show you how you can approach the conversation and position your case to get the best deal possible.

THE BEST NEWS EVER? We will close your knowledge gap and increase your management competence!

WHY DO YOU NEED LENDING SUPPORT

To avoid being seen by the banks as marginal, you must be able to CLEARLY and convincingly articulate WHY your lending proposition must be supported by the bank. This isn’t just when you apply for a bank loan – it must be each time you communicate with your bank.

We understand the pressures you are under and we have some valuable pointers for you when you are thinking of approaching the bank for that critical funding. Here are our top 10 tips:

#1 Explain your financials

If you want to take this a step further, identify your ‘one-phrase’ strategy. In other words identify the key lever in your business model that helps you make money. Apple’s one-phrase strategy is ‘closed architecture’, which has been the key source of profitability and a blocking strategy for its competitors. Google and Microsoft are beyond the point of no return as they will not be able to close their open systems.

#2 Talk about your future

Some CEOs explain their vision graphically. This provides more clarity and aligns both your team and all external people who are helping you along the way.

#3 Focus your team on cash

Cash flow is the only REALITY for the bank. This is a key part of their lending decision, so make sure it’s a key focus for you and your team too.

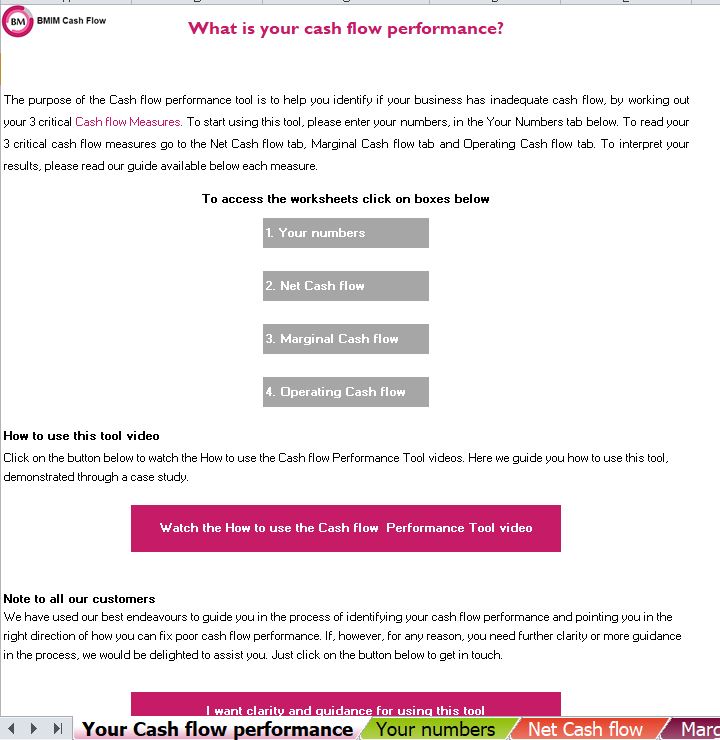

Start with our Cash Flow Performance tool . Sometimes cash is not performing as well as your profit and you can fix that. The hard part is knowing where to look.

With our Cash Flow Performance tool you can identify how and why you are short of cash and what you need to do to fix this in less than 6 minutes. Get the Cash Flow Performance tool by clicking the button below.

#4 Borrow for growth, not wastage

#5 Give the bank the option to exit

Ideally your focus should be on creating a buffer fund with the aim of becoming financially independent. There is nothing more rewarding than being able to self-finance your growth.

#6 Be the best in your industry

#7 Keep your bank informed of key industry challenges

#8 Present high level but know the detail

#9 Be profitable for them – they’ll do more to keep you!

#10 Treat your bank as your partner

IMPROVE YOUR LENDING PROPOSITION

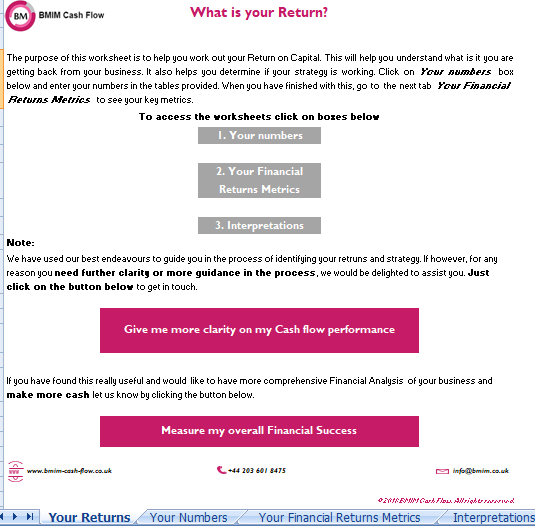

If you feel you are missing out on Lending opportunities for your business, or you want to improve your lending proposition – you need to see how the bank is measuring your cash flow/funding performance. The fastest way to improve your chances to get a bank loan is with our Funding tool. You can see exactly where you need to fix your cash AND it tells you exactly what to do when you find the gap.

Click on the button below to download your Funding tool.

RELATED LINKS

Read more about BMIM Cash flow

How we measure the success of your Strategy (WITH FREE TOOL)

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Early stage business financing: The pros and cons of taking money from Business Angels

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround