Early stage business financing: The pros and cons of taking money from Business Angels

If you want more aggressive growth and your business has a mid to high potential, it may be time to knock on a business angels door.

Who are business angels?

They are a high-net-worth individuals, usually successful business people or professionals, who provide early stage capital to start-up businesses in the form of either debt, equity capital, or both. They will provide financing to your start-up and early stage business too, if it is:

• Too small to get the attention of venture capitalist firms.

• Often too limited in the revenue potential at maturity to interest Venture capitalist firms.

• Too risky for bank loans and for most venture capitalist appetites.

Angels are often accustomed to taking calculated risks with their own money that banks may not be able to offer. However, they are also looking for higher returns on their investment.

Though business angels do allow small business to secure substantial amounts of capital the other advantage to angel funding is the knowledge and experience that they can provide. We’ve all seen the pitches in dragons den and the decisions that the successful have to make, in fact recent research shows that two thirds of businesses prioritise expertise over funding when looking for investment.

> Request my free meeting and help me grow my business today! <

As with any type of finance there will disadvantages as well as advantages that you need to consider.

• You are less likely to receive follow on investments from business angels, so if your business requires periodic investments you are better off with venture capital instead.

• Some business angels have limited expertise in running the particular type of business, making their contribution less value-added and more middle some to your business. Make sure you find the right angel for your business, that understands your product and your goals.

• Can be costly as they require a large ROI for their exit. This is reasonable as, from their prospective they are investing in very young and risky business, not yet established.

How to approach Business Angels for capital?

How can you bring your financing needs to their attention? Perhaps the best approach is to find a way into their network – through your accountant, other entrepreneurs in your network etc. Show your business plan to the right people. This may get the word out to the right people in the local angel network. There are now many angel platforms that businesses can make use of. In 2013 Angel’s Den secured £3.5M funding for businesses, turning out to be a record year for the team. There are also numerous events held throughout the year to allow businesses to connect with investors so get online and find an event near you.

Good luck with your business!

> Request my free meeting and help me grow my business today! <

Bibi Martin is the Founder of BM Interim Management, with over 10 years of expertise in the SME industry. Get in touch!

Post originally published via Business Matters Magazine – click here

RELATED LINKS

Read more about BMIM Cash flow

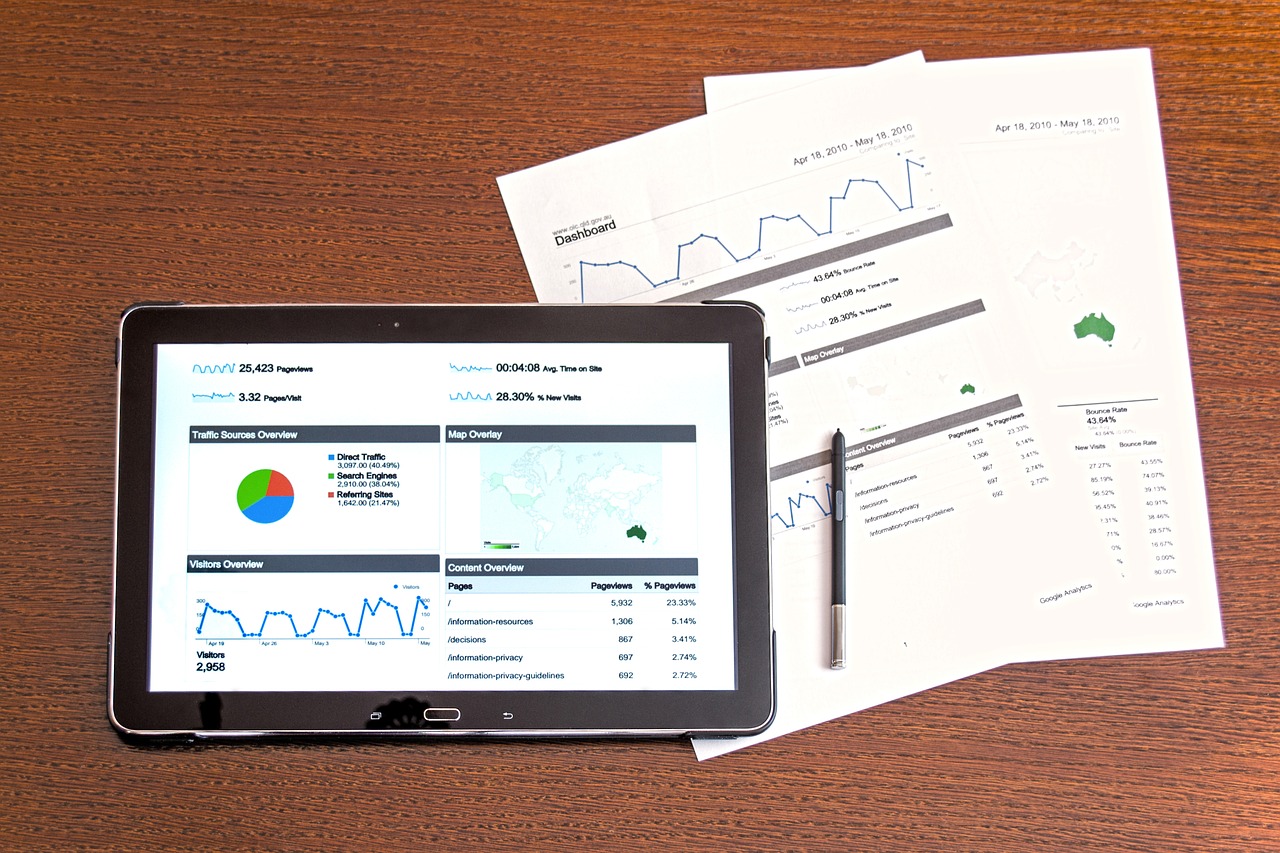

How we measure the success of your Strategy (WITH FREE TOOL)

How to fix your Working Capital problem…even if you are not “numbers person”?

Understanding your profitability picture (with FREE worksheet)

Turnover is vanity, Profit is sanity – but Cash flow is reality!

How to generate cash to self-finance your business?

Life-Cycle Financing of your Entrepreneurial Company

Case Study: Growing broke with inadequate cash flow

Case Study: Financial turnaround and re-invention

Case Study: Restructuring for Survival and Financial Turnaround